Home of some of the most monumental infrastructure feats, such as the Three Gorges Dam, the Shanghai Tower, the Tianhuangping Pumped Storage Power Station, and the unrivaled high-speed rail system, China is a benchmark competitor within the world of infrastructure.

Strategic Growth vs. Fiscal Responsibility

In the midst of a political battle within the US (China’s biggest economic and geopolitical competitor) in regard to an impending $1.25 trillion infrastructure bill, it is evident that the premise of the political battle in DC is in regard to the price tag, and subsequently the marginal benefit of said bill; more or less the fiscal responsibility of the bill. Though improved infrastructure is a great way to increase employment alongside the labor force participation rate, and in overall, promote economic growth; a fiscally irresponsible effort on infrastructure development can cause detrimental effects in the long-run for an economy, and the financial health of an economy… let alone the global economy, with respects to the magnitude of nations like the US and China.

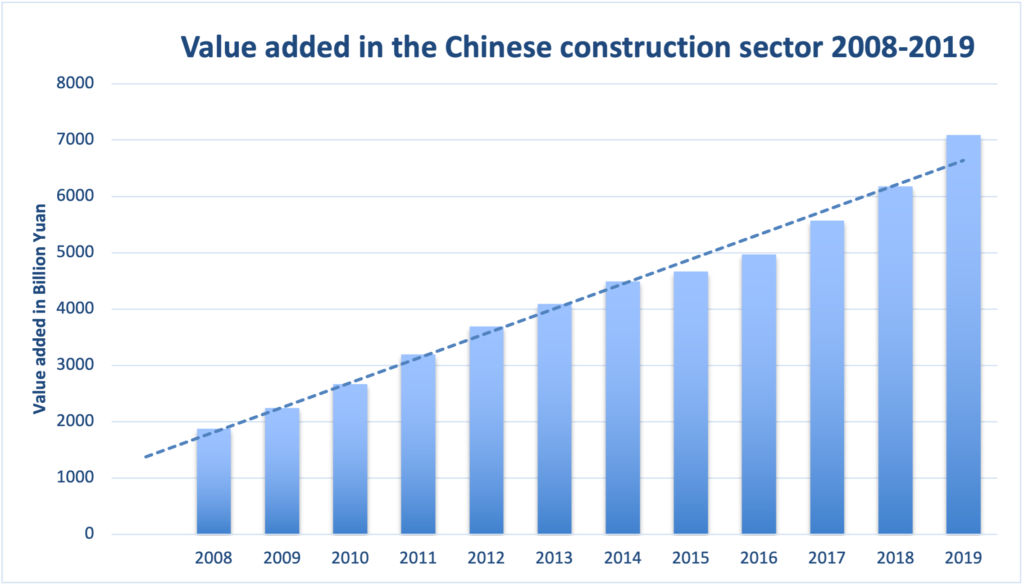

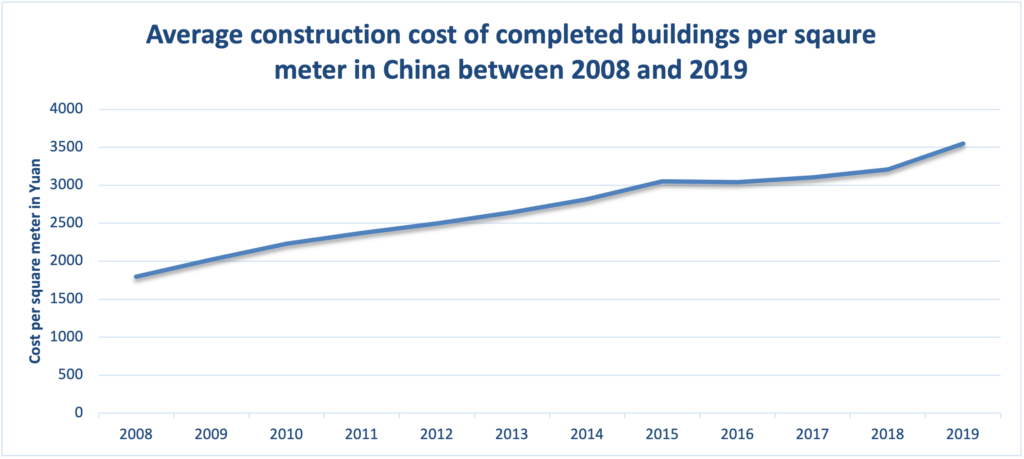

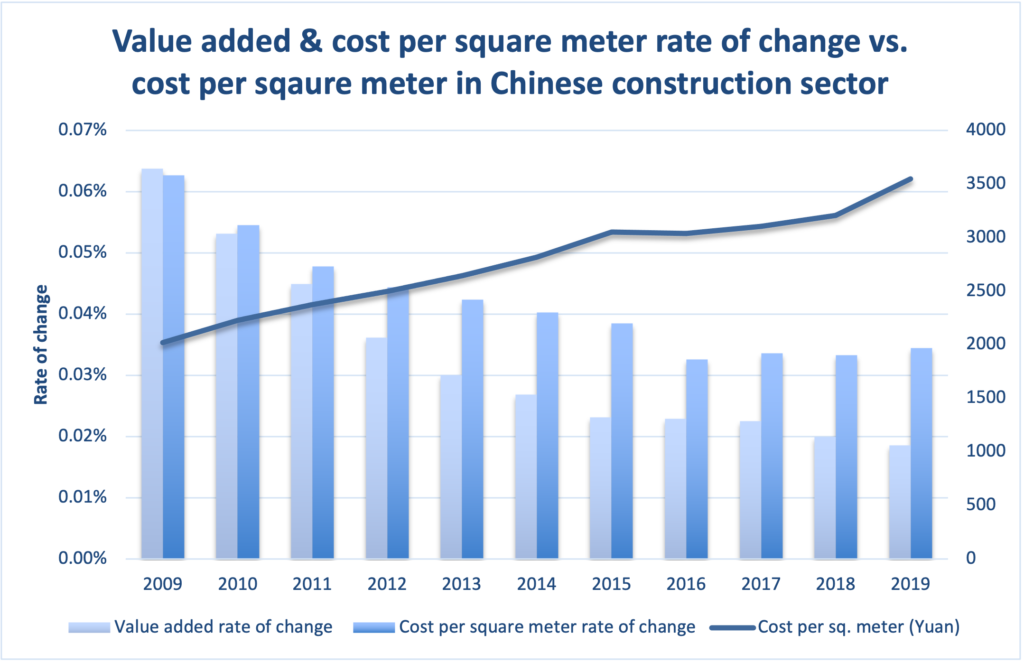

Given the state of the US and its infrastructure, and the dynamics of the geopolitical tensions that have recently been rising between China and the US, China sought out infrastructure as a strategic investment to increase its economic footprint on the global economy, and to bolster its multilateral initiatives (i.e., Belt Road Initiative). This strategic investment initiative, though making China the largest construction market in the world and seeing constant returns to scale in terms of value added (Figure 1), the initiative has been nothing short of expensive as China has experienced rising construction costs (Figure 2) alongside the increased construction volumes. Pairing this dynamic with the fact that the rate of change in construction costs has outpaced the rate of change in value added in the construction sector of the Chinese economy, has dimmed some of the lights on the utility value of the recent initiatives, and has imposed risks of possible (and developing) negative externalities on the Chinese economy (Figure 3).

Risk & Return

To extrapolate on the endogenously derived dynamic of cost inefficiency within China’s investment initiatives, let’s look at 2 outliers that have caused the most damage to the Chinese initiatives.

High Speed Rail Woes

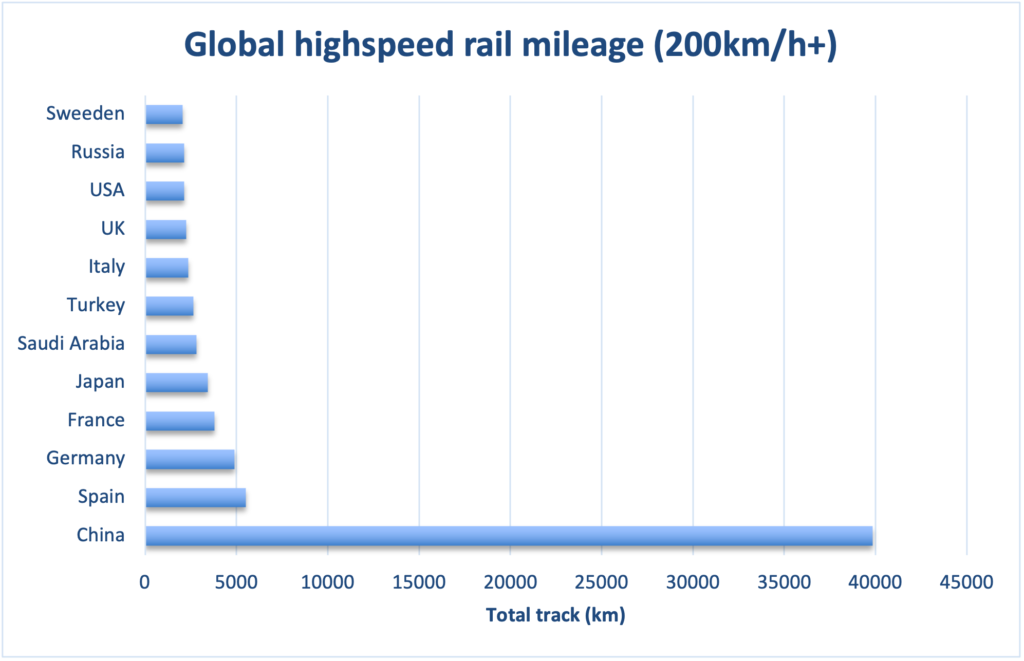

As China hosts the global title for highspeed rail infrastructure (Figure 4), China has the absolute advantage when it comes to highspeed rail infrastructure; it is key to note that this is the main “export” of China’s Belt Road initiative. But as we mentioned before, big projects carry big price tags, and as China’s highspeed rail system is the largest, it is also the leader in debt and operating losses. China State Railway Group Co., Ltd, who is the state-owned enterprise that was founded by the Ministry of Railways of China and the China Railway Corporation in 2019, reported its H12021 results which showed that the company reported a healthy revenue of 512.8 billion RMB, but a net loss of 50.7 billion RMB. How is that possible with 1.33 billion passengers, an uptick of 65.5% YTD? Simply input costs, and in particular, electricity costs. With a 250km/h+ train consuming 4800 kw/h, and according to the National Bureau of Statistics of China, the price of electricity price for a high-speed train in 2019 was approximately 1 RMB/kw, but with China’s electricity costs rising in lieu of their energy supply constraints, this figure is bound to rise.

When we look at the balance sheet dynamics of China State Railway Group Co., Ltd, we can also note that the total liabilities for China State Railway Group Co., Ltd, reached 5.8 trillion RMB and their total assets sitting at 8.76 trillion RMB, but with a Gearing Ratio of 66%.

Given that the construction of China’s high-speed rails heavily relies on bond issuance and bank loans, we can further extrapolate to find that from 2016-2019 China State Railway Group Co. Ltd issued approximately 300 billion RMB in bonds per year where only 200 billion of that accumulated debt was used for maintenance and equipment purchases. The remaining amount was utilized for debt restructuring. Most of the bonds that China State Railway Group Co. Ltd issued carry a 5-year maturity term (peak issuance was in 2016). This signals that China State Railway Group Co. Ltd is at an ample risk for their Gearing ratio to substantially increase and subsequently face insolvency risks. Outside of debt-sourced funding China State Railway Group Co. Ltd also heavily relies on governmental subsidies and this dynamic has also caused strain on the fiscal health of the perspective local governments, and in particular, the western regions that experience low passenger volume and density.

Fighting Fire With Fire

Chinese local governments have sought out to combat the railway induced debt via concept cities that allocate large areas of commercial and residential development (i.e., Ordos). However, due to their remote location, economic inputs such as labor, goods and services are relatively scarce. This ultimately has led to the widely popular term of “ghost cities”. This can be extrapolated with the report from the National Bureau of Statistics of China that reads that in September 2021, investment by real estate developers fell 3.5% YoY, and apartment unit sales fell 16.9% YoY. This can be paired with the reports from the National Bureau of Statistics of China that the amount of local government debt accumulated and liabilities across China has reached a figure of 18.29 trillion RMB, and also with China Data Bank & Tencent Finance reporting that 85 Chinese cities have exceeded a 100% debt ratio in 2020, and the top 10 Chinese cities have all exceeded 500% (Guiyang as an outlier at 929%).

With the elephant in the room of Evergrande and its counterparts of Sunac China, Fantasia, and Sinic holdings, having all reported debt defaults in the past 3 payment periods. It is key to note that these companies make up the bulk of China’s real estate development volume. Pairing this with the fact that the Chinese real estate sector has a 69% share of high-yield bonds, and the Chinese high-yield bond spreads are off the 2190 (approx.) bps level and trending to re-test that level.

Moral of the Story

These credit market woes (and in addition to the recent energy crisis) in China can cause detrimental effects on the outlook of the Chinese economy and subsequently the global economy as already mentioned. Investors should be highly weary of this dynamic, particularly sovereign bond investors.