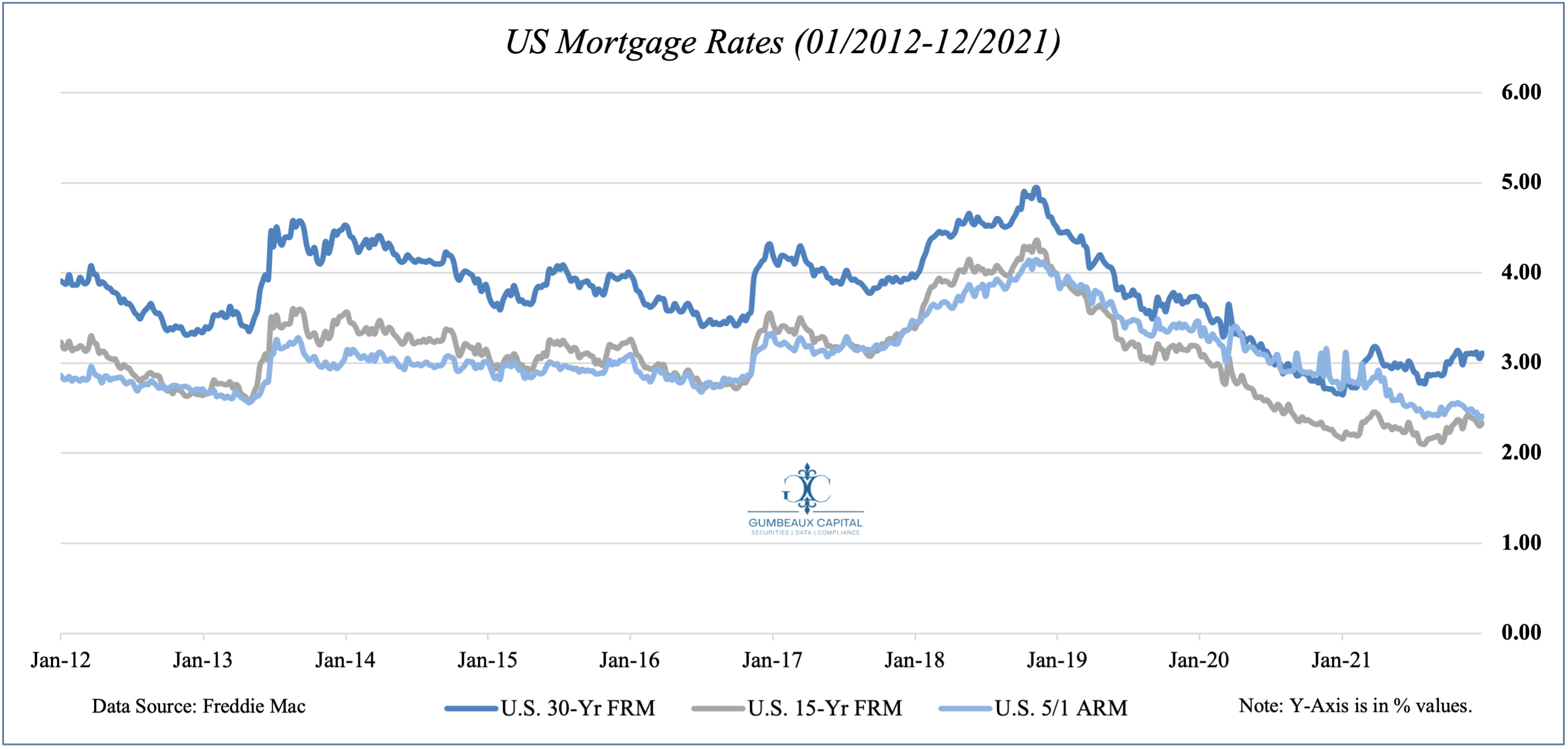

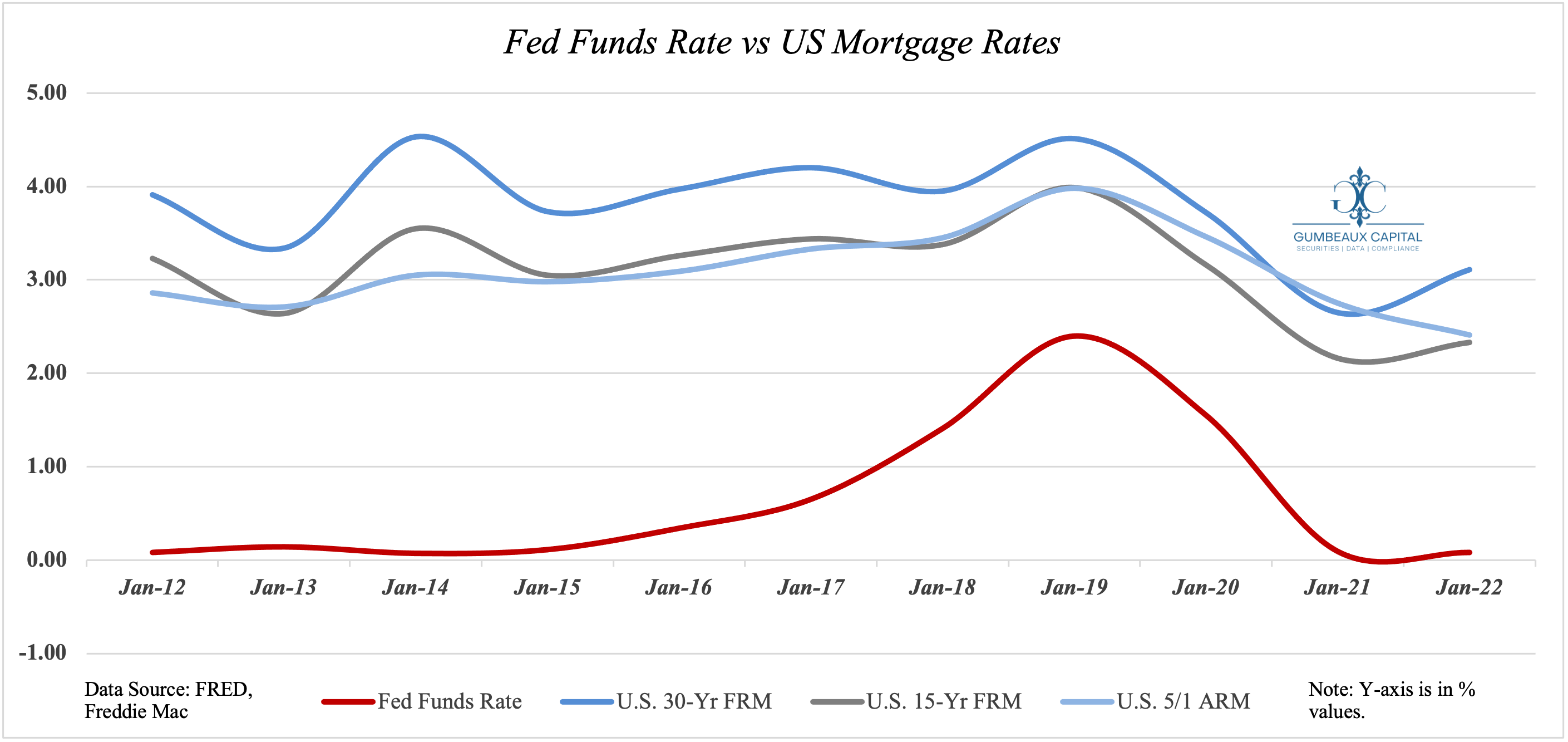

Given that the Federal Reserve seeks to hike interest rates in 2022 from their historical lows, it is inherent to many consumers and lenders that Mortgage rates will subsequently rise. When taking a look at relatively historical data on mortgage rates (Figure 1), we can note that the current environment of mortgage rates are a simple reflection of the Fed funds rate (Figure 2).

“Taper Tantrum” Flashbacks

To extrapolate upon the imminent policy neutralization, we can take a look back at the 2013 “taper tantrum” activity in the context of mortgage rates. When looking back at the 2013 “Taper Tantrum” we can see an abundance of similarities in today’s dynamics:

The late January 2013 meeting carried a hawkish tone to it where the Federal Reserve’s “QE” program was in talks to be tapered out by year’s end. At the Fed’s March 2013 policy meeting, it was discussed that the Fed would “gradually” allow their balance sheet to shrink by letting the purchased bonds mature rather than selling them. In May of 2013, Fed Chairman Ben Bernanke spoke in front of Congress and commented, “If we see continued improvement and we have confidence that that’s going to be sustained then we could in the next few meetings … take a step down in our pace of purchases.” Bernanke’s comments caused bond yields to rise and equity prices to fall. Come June of 2013, the Fed had still not made a commitment to taper their bond purchases. It would not be until December of 2013 that the Federal Reserve began to commit to a tapering on their bond purchases. Through this time period we saw major increases in US Mortgage rates. We saw a 121 basis point jump in the 30-Yr FRM, an 89 basis point jump in the 15-Yr FRM, and a 35 basis point jump in the 5/1 ARM. It is key to note that also during this event, PCE inflation deviated between 1.4% and 1.7% at the time; this is in contrast to the PCE levels we see today at 4.85%.

With a sustainably higher price levels, the Fed has a lot more propensity to get significantly more aggressive on their tightening and tapering framework relative to 2013. At a base case, if we see an impulse in yields, and subsequently rates, we can expect to see 5.4% 30-Yr FRM, a 4.06% 15-Yr FRM, and a 3.47 5/1 ARM at the peak of the tightening cycle.

Rising Rates and Price Dynamics

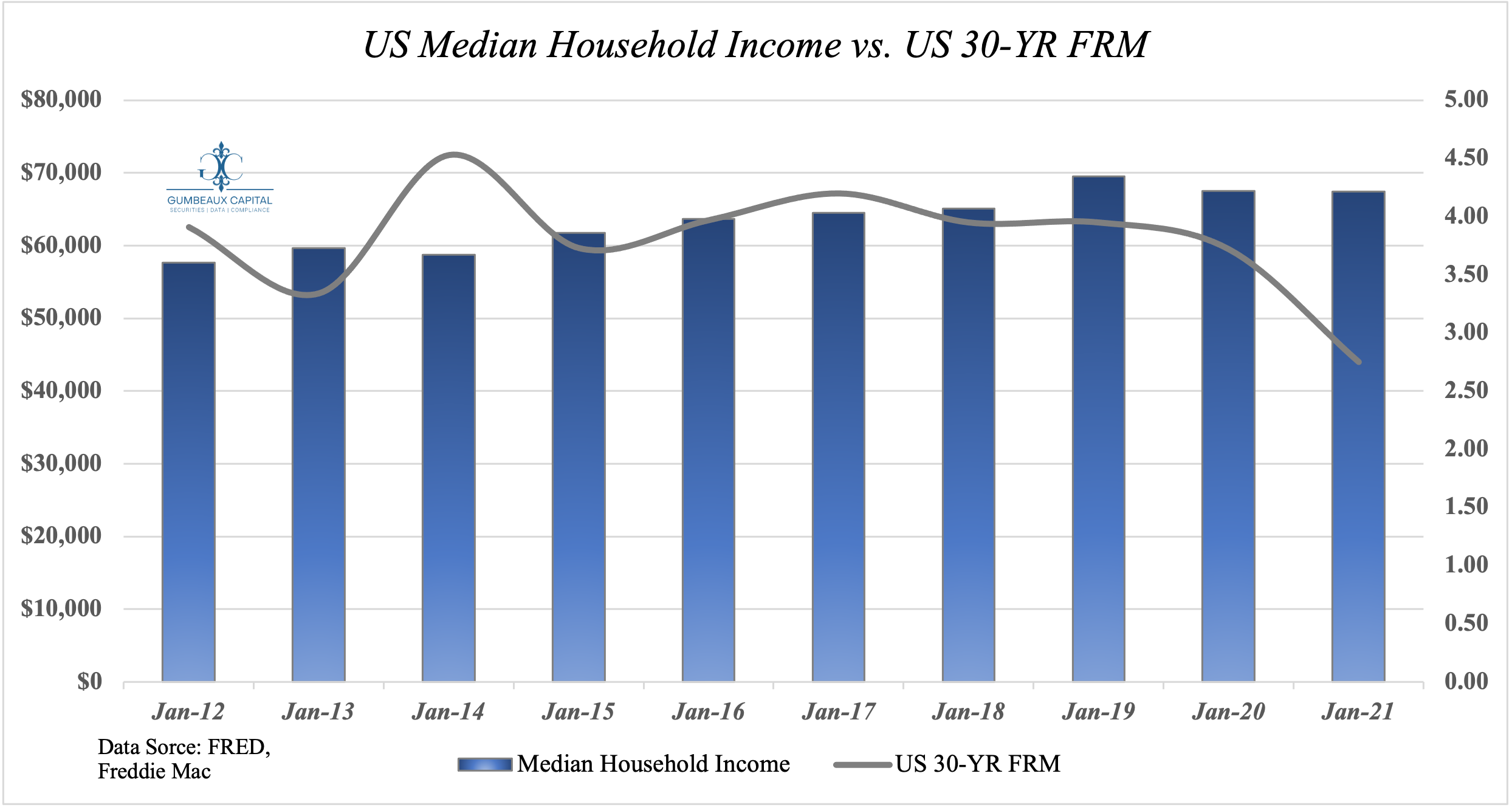

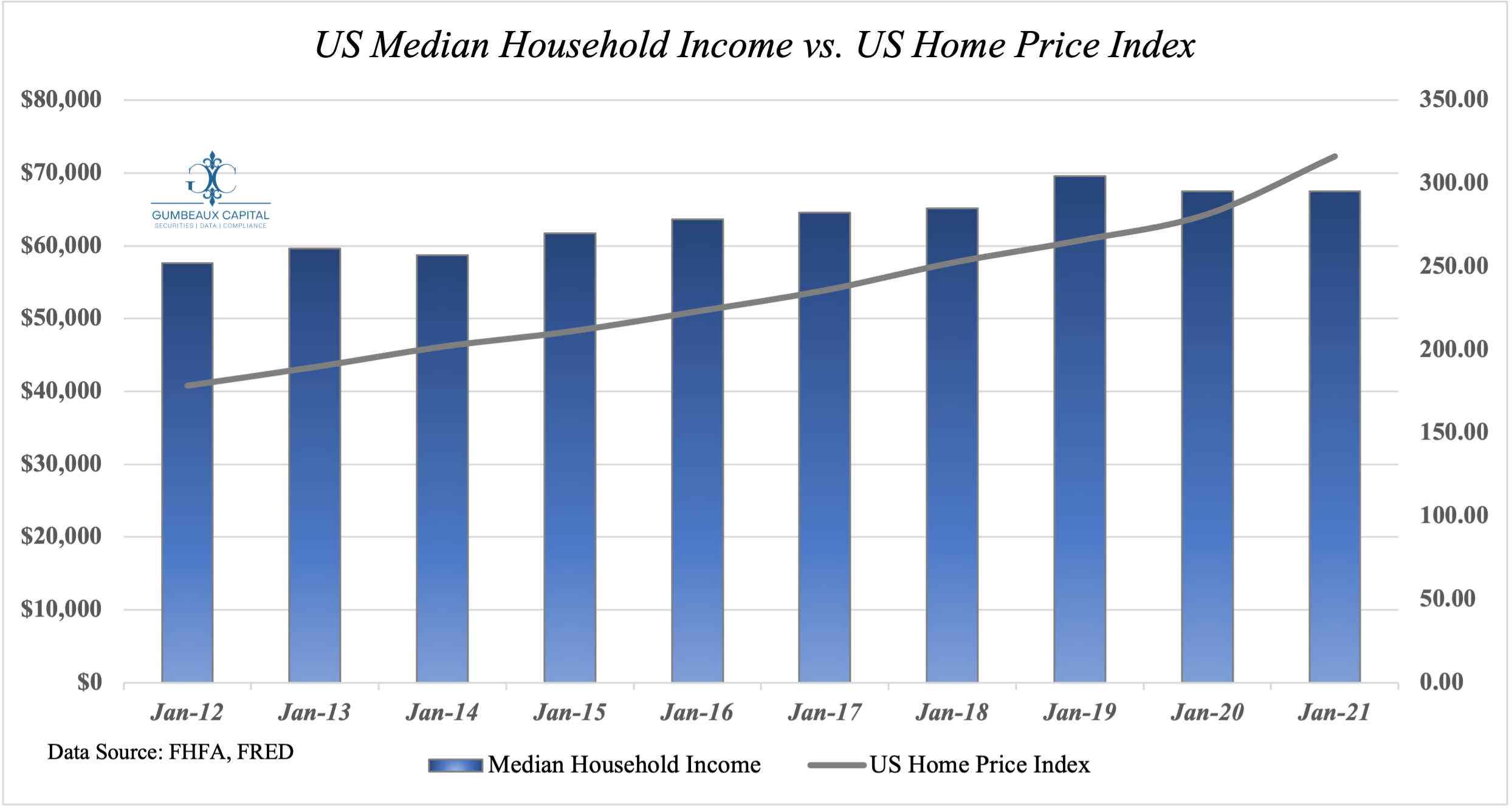

With the Federal Reserve bolstering accommodative policy through the pandemic, in which provided a gateway to higher household income; subsequently sending 30-Yr mortgage rates down 100 basis points from its January 2019 levels (Figure 3), and we saw home prices rise in tandem with household income (Figure 4).

With these dynamics in context, we can expect the inverse to extrapolate in a higher rate environment. We can note exogenously that higher interest rates cause household income to taper (along with access to credit), which in-turn will imply an easing effect on home prices.

Some tailwinds in the housing market may persist albeit the current labor picture in the US as the labor market continues to progress in its recovery. These dynamics may reduce the velocity of the impending household income taper, and soften the inherent reduced demand that we will experience amidst the Federal Reserve’s normalization policy initiatives.

Forward Strategy

To fully contextualize the outlook on the US housing market, following wage growth will be key in measuring the velocity of tailwinds pushing the housing market forward (for investors & lenders).

It will also be key for potential buyers to focus on their 2-5 year income outlook to offset the oncoming rate differentials relative to our current environment to mitigate any incurred real costs (higher rates and inflation). Having a strategic approach on expected future earnings will bolster an opportunity to take advantage of refinance programs at the completion of the normalization and tightening cycle.