As the US Senate failed on Monday (09/27/2021) to advance on suspending the federal debt ceiling, there is now an ample risk that the government will have a partial shutdown, and or the inability of the government to pay its bills, according to Treasury Secretary Janet Yellen. This subsequently poses a risk of a trajectory leading to a default on US treasuries.

As the fiscal year ends on September 30th, 2021, this is the date government funding is set to expire. In lieu of the expiration date, House Democrats passed a bill that aims to suspend the US debt ceiling into 2022, and keep the government operating until at least December 3rd, 2021. Despite the contingency plan, the House bill has faced adversity in the Senate as Senate Republicans oppose a short-term framework to raise the debt ceiling.

The game of Hardball

Despite Republican Senate leader Mitch McConnell stating in an interview that, “America must never default,” the Senator continues to lead the blockade In the measures to lift the ceiling. McConnell also stated that “The debt ceiling needs to be raised. The issue is who should do it. And under these uniquely unprecedented circumstances, it’s their obligation to do it. And they have the votes to do it, and they will do it.” So it is evident that this is a game of hardball and not so much of a binary debate on the debt ceiling.

Infrastructure Bill

This game of hardball is being played on the pitch (or the infrastructure memorial stadium for my Americans) of infrastructure. The underlying reason for the current blockade is due to the dynamic that, [McConnell] “not because it doesn’t need to be done,” but because doing so would pave the way for Democrats to pass a $3.5 trillion human infrastructure bill that would undo most of former President Donald Trump’s 2017 tax cut. In lieu of this, the Republicans have suggested a reconciliation framework to the Democrats that would allow the bill to pass with a majority vote in the Senate rather than the 60% chamber vote. The Democrats have rejected this proposition as they say that this is a bipartisan issue, [Schumer] “Anyone who says this is Democrats’ debt is not talking fact, they’re talking fiction. Both sides have a responsibility to pay for the debt we’ve already incurred.” It is also key to note that if the Democrats would proceed with the reconciliation framework, they would be virtually obligated to raise the debt limit by a specific dollar amount rather than a time-based suspension. This would put the responsibility of increasing the debt ceiling solely on Democrats, and once again risk the $3.5 trillion infrastructure bill that is already in adverse light with some Democrats.

Market Effects

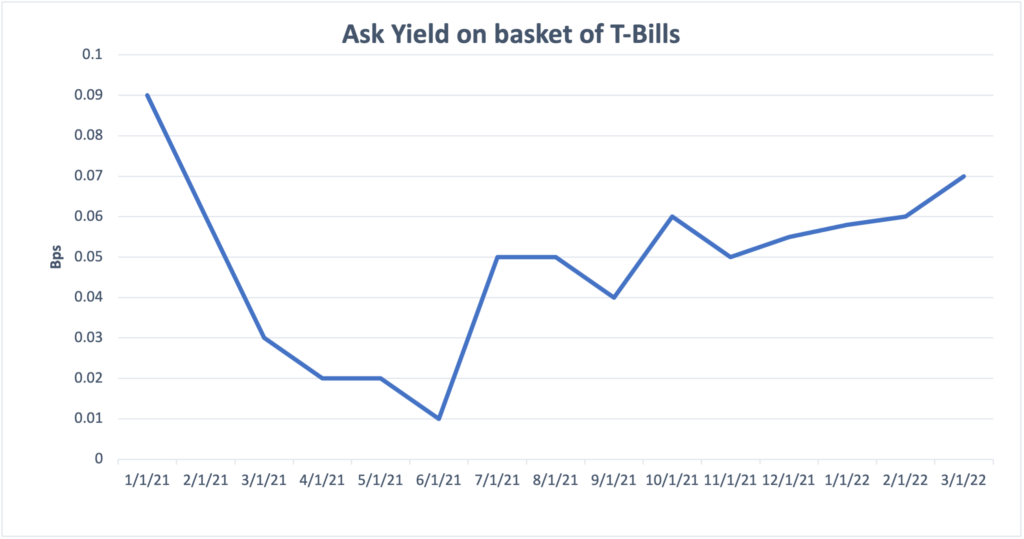

With a debt ceiling suspension, there will be an increase in net Treasury issuance of $700 billion. This $700 billion will likely be allotted between October and year-end as the treasury market yields signal issuance (Chart 1).

This could also signal that October could be home to the US Treasury’s infamous “X date”. As we discussed and foreshadowed this dynamic in https://gumbeauxcapital.com/2021/03/10/liquidity-mania-2021/ , we can further expect USD to extrapolate the impending higher rate environments it will endure.

Investors should expect higher rates across the board, and this high rate environment is at possibility of becoming “sticky” as the Fed’s tone from last week’s FOMC meeting was more on the hawkish end, along with the dynamics revolving the fiscal state of the US signaling higher yields.