As global oil demand, and subsequently, consumption begins to recoup, there are many questions about the future of oil in terms of capital markets. Many investors remain weary as to if the infamous cyclical sector will be a positive attribute to their portfolios.

Demand-Pull Dynamics

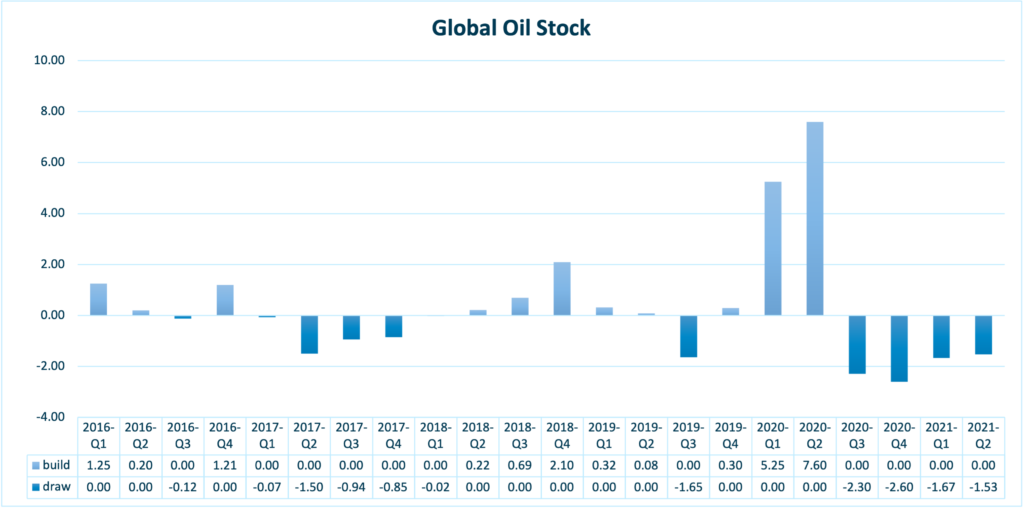

With global oil demand on its way back to “normal” levels: EIA: “U.S. gasoline consumption will average 9.1 million barrels per day (b/d) this summer (April–September), which is 1.3 million b/d more than last summer but still more than 0.4 million b/d less than summer 2019. Weekly consumption data reflect the Colonial Pipeline outage and subsequent increase in gasoline demand, but consumption both before and after this event indicate more gasoline demand than we had previously forecast. Our latest forecast also reflects IHS Markit’s increased employment forecast. We expect U.S. gasoline consumption to average 8.7 million b/d in for all of 2021 and 9.0 million b/d in 2022.” This is widely reflected within the global stock balances as the global oil stock has sit in a draw for essentially an entire fiscal year (H2 2020- H1 2021) (See Figure 1).

This in hand has been a main attribute to oil prices seeing a recent uptick which we elaborated on in:

Equity Outperformance

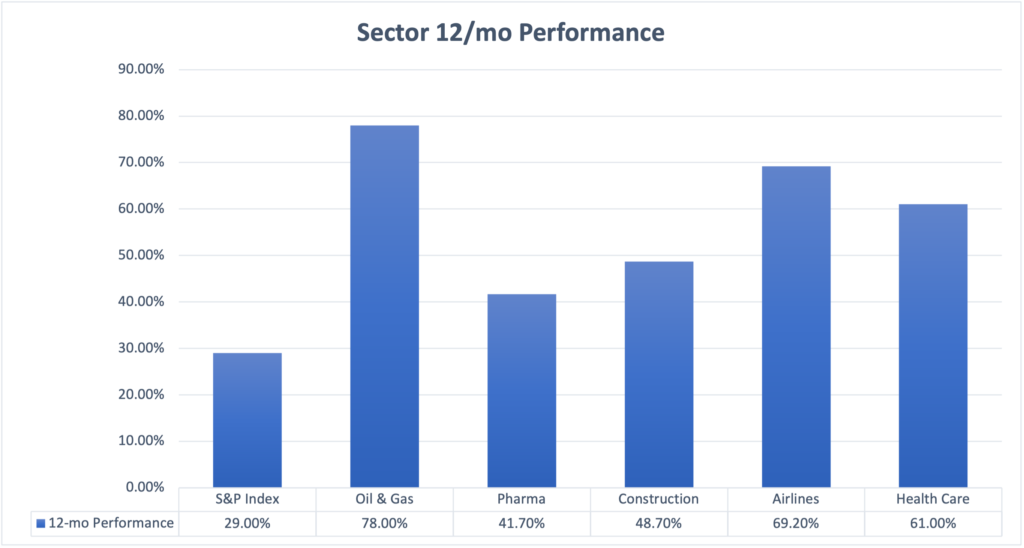

This price dynamic has led to an overall outperformance in the financial markets in 12-mo terms (see Figure 2).

“Mitigation”

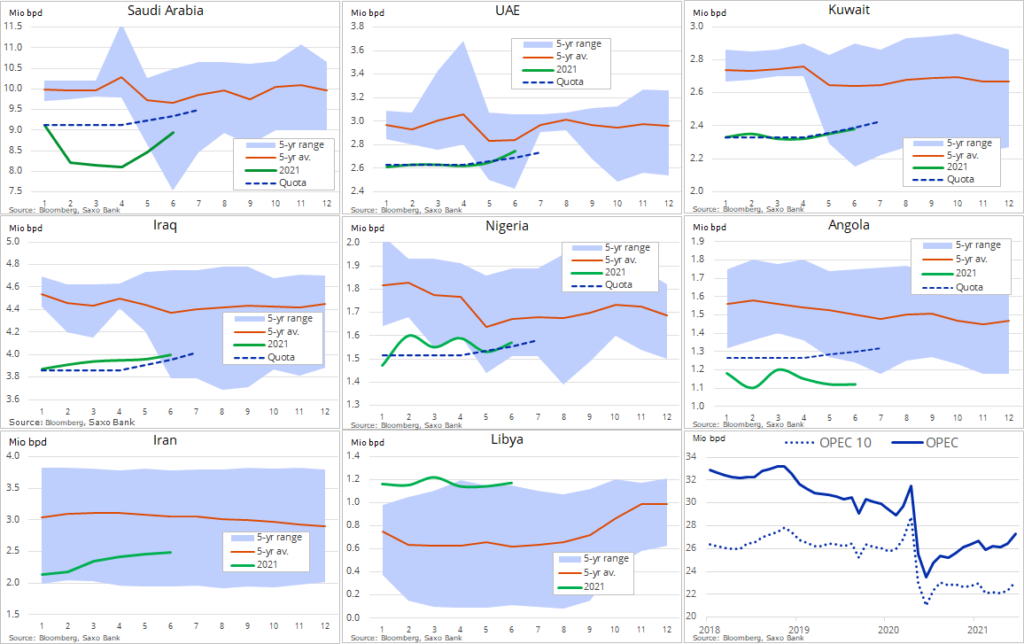

As of Friday, July 2nd 2021, the OPEC+ alliance are resuming talks about raising oil output. This is following the measurement that OPEC output has risen 855,000 barrels per day in the month of June. This brings the total OPEC daily output per day to roughly 25 million barrels (see Figure 3).

Nonetheless, OPEC+ looks to add more oil to the market from August and extend the duration of the pact on the outstanding production curbs. The only drawback being the UAE opposing the extension, and to reach an official consensus, OPEC+ requires an unanimous decision. It is key to note that the UAE does support the increase in production, but the argument in hand is derives from the quantity in production in which it wants a higher baseline. Overall this could lead to an “easing” of aggregate pricing.

What about all of the price optimism?

Analysts are eyeing in the range of $75-$100 a barrel for WTI, and Brent is already trading in at around $75 (which holds as a 2 year high). It is key to note, that regardless of the current situation, oil production is poised to substantially increase to fill imbalances within the supply chain. This will cause great amounts of volatility within oil prices, and create lots of downside risk despite the analyst consensus. On the bright side, across the board, firms in the sector are boasting record free cash-flows, and eyeing to deleverage their balance sheets in the coming months.

All in all, the oil & gas sector is approaching a “perfect-storm” in the eye of capital markets.

Investors should key firms with high (relative to sector) capital expenditures (capex), and or firms focusing on balance sheet flexibility to reap the highest quality benefits of these macro-dynamics.

Equities to watch:

Royal Dutch Shell (NYSE: RDS.A)

According to Shell’s outlook, their top priority in their capital allocation framework is:

- Apportion near-term $19-22 billion cash capital expenditure:

- Marketing ~$3 billion; Renewables and Energy Solutions $2-3 billion; Integrated Gas ~$4 billion; Chemicals and Products $4-5 billion; Upstream ~$8 billion

- Inorganic capex included in range

- ~4% dividend per share growth annually, subject to Board approval

This is a textbook example of what investors should look for in the current dynamics of the oil & gas sector.

ExxonMobil (NYSE: XOM)

On the flip side, even though Exxon has cut its capex guidance for 2021, they have focused on their balance sheet flexibility which captures the “other” strategic point in capital market attractiveness:

- Deferred 2020-25 investments of ~$50 billion; value deferred with delayed implementation

- ~90% of 2021-25 Upstream investments have cost-of-supply ≤$35/bbl

- Finalizing >$1 billion North Sea divestment; 10 assets in market

- Reduced 2020 cash Opex by18% versus 2019

Occidental Petroleum (NYSE: OXY)

Even though Occidental was one of the hardest hit firms in 2020, their guidance looks strategically poised to generate returns for investors:

- Occidental expects to invest $2.9 billion in 2021 to further strengthen the existing operations compared with $2.53 billion invested in 2020. Out of the 2021 projected capital expenditure, $1.2 billion will be invested in the Permian region to bring new wells online.

British Petroleum (NYSE: BP)

Like Exxon, BP aims to further add flexibility to their balance sheet. BP also seems to be very aggressive with cost savings, while prioritizing their maximization of EBITDA in the coming years:

- $3-4 billion of cash cost savings by 2023, relative to 2019

- Aims to almost double EBITDA by 2030 relative to 2019 while maintaining ROACE of 15-20%

- BP: “We plan to double our 2019 gross margin to more than $2bn by 2030. We plan to drive growth and margin expansion as we roll-out strategic convenience sites and enhance our retail offer supported by digital and loyalty programmes. We will make disclosures on each of these metrics.”

Connoco Phillips (NYSE: COP)

Connoco Phillips has an aggressive approach to bolster their free cash flow in the near-term:

- Conoco anticipates cash from operations of ~$145B and free cash flow of ~$70B over its 10-year plan period.

- The company also raises expected synergies savings from its deal to buy Concho Resources to $1B annually, compared with its previous forecast of $750M.